35%

Faster Loan Processing

50%

More Accurate Compliance Reporting

3x

Faster Client Onboarding

100+

Trusted Implementations

650+

Salesforce Experts

Why the Financial Services Sector is Turning to Salesforce CRM

In financial services, fragmented systems and outdated CRMs lead to compliance risks, customer churn, and operational delays. Salesforce Financial Services Cloud consolidates your front, middle, and back office on one intelligent platform.

Without a centralized CRM:

- Advisors toggle between spreadsheets, tools, and email threads

- Compliance reviews become reactive and resource-heavy

- Loan and investment cycles stall due to fragmented data

With Salesforce:

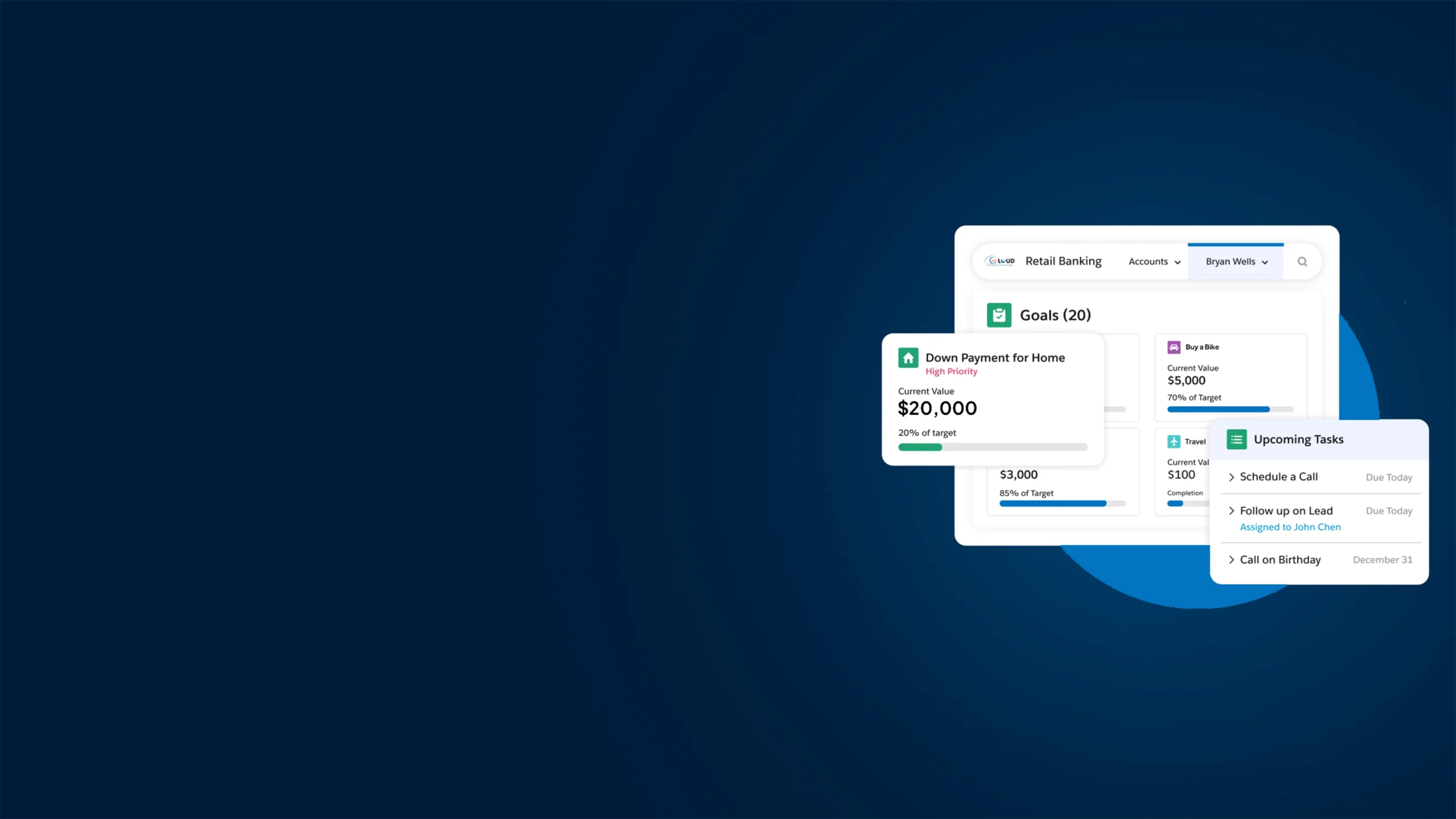

- View each client’s financial journey in real time—across banking, wealth, and insurance

- Deliver compliant, personalized services with AI-based nudges and automation

- Connect relationship managers, underwriters, agents, and compliance in one flow

Still Depending on Spreadsheets for Loan or Compliance Tracking?

Salesforce Consulting Services Designed for Financial Institutions

Whether you're a commercial bank, NBFC, insurer, or investment advisory firm, we tailor Salesforce to match your operations, regulatory obligations, and customer lifecycle.

Salesforce Products We Customize for Financial Services Success

Each of these Salesforce products can be configured to serve a specialized financial use case—lending, insurance, investment management, or compliance.

Awards & Accolades

Salesforce Insights & Updates

Stay ahead with the latest insights, expert tips, and industry trends—featuring exclusive tips and tricks from our Salesforce experts to drive innovation and success.

Salesforce Services

Salesforce Services

Top Salesforce Consulting Partners in India You Can Count On

The global CRM market size was valued to be around USD 112.91 billion in 2025 and is expected to grow from USD 126.17 billion in 2026 to…

Read More Salesforce Services

Salesforce Services

Salesforce Partners: What They Are, Partner Tiers & Why You Need One

Implementing Salesforce for business operations can often be described as buying a high-performance jet; no wonder it’s an incredible piece of machinery, but it won’t get you off the ground without a…

Read More Hire Staff

Hire Staff

Hire a Salesforce Developer: 7 Reasons Your Business Needs One

Whenever a company starts getting Salesforce projects, and work starts to pile up, the first option that comes to their mind is to look for…

Read MoreGet a CRM Strategy Tailored for Your Financial Workflows.

Frequently Asked Questions

What is Salesforce for Financial Services and how does it help?

Salesforce for Financial Services is a purpose-built CRM that helps banks, lenders, and wealth management firms manage client relationships, automate compliance, and deliver personalized experiences—all from one secure platform.

What does a Salesforce Financial Services Cloud implementation include?

A Salesforce Financial Services Cloud implementation typically includes CRM configuration, data migration, compliance automation, AI setup, and integration with core systems to support personalized client engagement and regulatory readiness.

Can Salesforce integrate with core banking systems and legacy financial tools?

Yes. We offer custom Salesforce solutions for banks that include seamless integration with core banking systems, payment gateways, fraud detection tools, and ERP platforms to enable unified, real-time data flow.

Is Salesforce secure enough for financial compliance and regulatory needs?

Absolutely. Salesforce compliance solutions for finance support KYC, AML, audit trails, and data encryption—backed by global standards like SOC 2, ISO 27001, and GDPR.

Which financial operations can benefit from Salesforce automation?

Salesforce automation for finance can streamline key workflows such as loan origination, credit approvals, claims processing, investment planning, and customer onboarding—while improving speed and accuracy.

Can Salesforce be used to build a custom loan management system?

Yes. We can develop a Salesforce loan management system tailored to your lending process—from pre-qualification and underwriting to servicing and renewals—all with automation and compliance baked in.

How does Salesforce support wealth management firms?

With a tailored Salesforce app for wealth management, advisors can access 360° client views, track financial goals, manage portfolios, and deliver hyper-personalized advisory services through a single interface.

Got a Question? Ask Us!

Ready to Solidify Your Digital Transformation Efforts Using Salesforce? Talk to Us!

Subscribe to our newsletter

Stay ahead with expert insights, industry trends, and exclusive resources—delivered straight to your inbox.